Saving Tips from a Shopper

I am a self confessed shopper but I feel really bad if I hit my shopping quota for the month. That is because as much as I am a shopper, I am also a saver. I buy things I can actually afford to pay at that very moment I purchased the item. Hitting my shopping quota would mean I have less money to save. What do I do so I will be less guilty? I plan to save more the following month - maybe less coffee, less mall visits, etc.

So here are some of the adjustments I make. Maybe you'll find some to be applicable to you.

(Sorry, this is a long post)

Phone/Mobile phone:

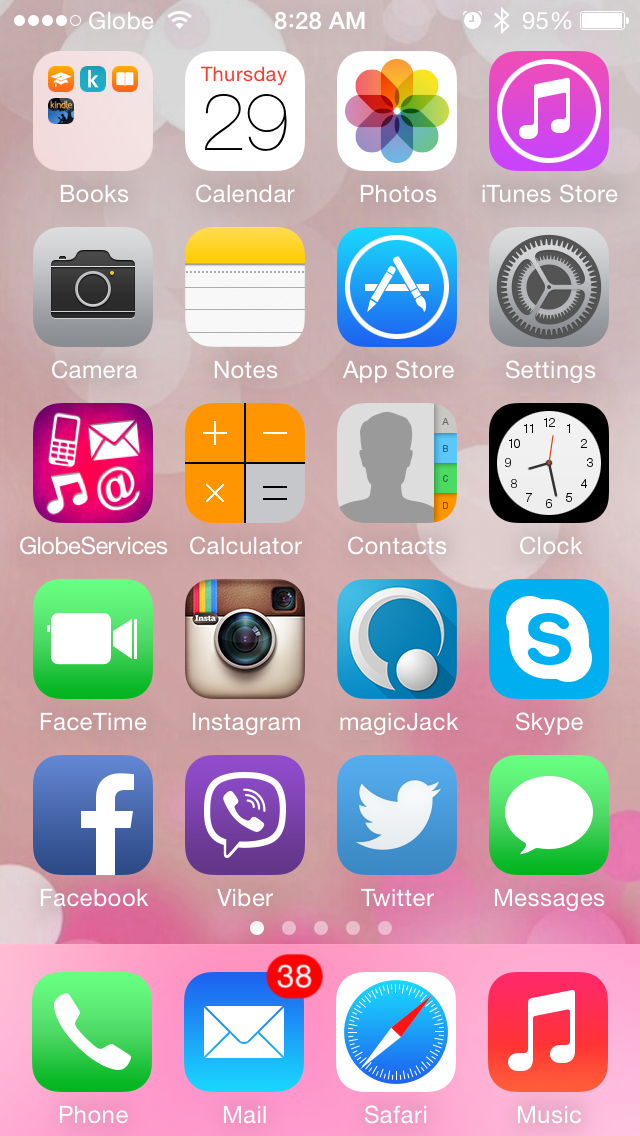

I am on Globe pre-paid for the longest time. Phone companies changes their promos every few months so that gives me variety of choices which can match my changing needs.

I save more by loading P1000 which gives me 250 free text compared to P500 with 85 free text or 300 with 35 free text. As most of my family members and friends have either smartphones or tablets, I communicate with them using iMessage, Viber, Facebook messenger, email and Skype. I just subscribe to GoSurf99 - 100 MB valid for 30 days for only P99. For others without these internet communication apps, I have 250 free text to all to use.

Vouchers:

There are a lot of companies now offering deals and with the very nice photos and big "savings" advertised, very tempting indeed. But be sure to call the company/store and ask them for the usual price.

A product is currently being advertised with 30% off from an "original price" of P395. Checking the website, it's only P295. The picture I have is a few months old but I don't think the store would have increased their price by more than 25%.

Coffee / Tea / Milk Tea:

I love coffee and tea but I limit my purchase. I always try to look at my budget on a monthly basis.

Ex. a Starbucks coffee on an average would be around P120 plus an ordinary pastry worth P60 can easily add P180 to my daily expenses. Having this 2x a week or 8x a month will add a total of P1440 to my monthly expenses. I try to save by either substituting to a better deal or lesser visit to my fave coffee shop.

Insurance:

Review your insurance policies. Maybe you are paying for something you don't need. If you don't have dependents (or people around you can work and survive when you're not around anymore), you may not need a Life insurance. A Health, accident or pension plan may be a better option. Remember, if you're paying 35K a year for a 1M policy, in 15 years, that is P525,000.

Credit Card:

Make sure to pay your credit card bills on time and in full. Normally the listed interest would be around 3.5% per month. However, it is computed on a daily basis, so if you don't pay by the due date stated, the 3.5% interest doubles. A P10,000 credit card bill will have an estimated charge of 700 (10,000 * 7%) + P500 late charge = P1,200 which represents a hard earned money you will never get to enjoy, amount you may have used for Mobile load, 1month coffee, or a new shirt.

Instalment Plans:

Think 100x before buying anything on instalment.

Example: The monthly amortisation for a new car worth P800,000 will be around P26,300.

P26,300 X 36 months = P946,800

That means paying P146,800 in interest alone for a car that has already depreciated by P150,000 (est.) in 3 years.

Vanity:

I don't find anything wrong with taking care of oneself. But be sure you can actually afford it. Most of my girlfriends go for Manicure (P300) , Pedicure (P400), Hot Oil Treatment (P1200), Facial Treatment (P2000) and Massage (P600) every month. If having all these once a month, that would be P4,500 added to the monthly budget or a whooping P54,000 a year. Doing this every other month would save P27,000/year. Or making a few more adjustments would give more savings. mmm.. I love savings.. :)

I can go on and on but the reality is we should just always be mindful of our finances so that we can save for our future. We can enjoy now but still making sure we can still enjoy life in the years to come. How many people do we know are dependent to their sons or daughters now that they are old and can't work anymore? Or people who need to sell their properties at half the price of the market value because they need money urgently for school or medication? Or a 30-something professional still dependent to his/her parents for life's necessities?

Let us all me be a smart shopper and a dilligent saver.

So here are some of the adjustments I make. Maybe you'll find some to be applicable to you.

(Sorry, this is a long post)

Phone/Mobile phone:

I am on Globe pre-paid for the longest time. Phone companies changes their promos every few months so that gives me variety of choices which can match my changing needs.

I save more by loading P1000 which gives me 250 free text compared to P500 with 85 free text or 300 with 35 free text. As most of my family members and friends have either smartphones or tablets, I communicate with them using iMessage, Viber, Facebook messenger, email and Skype. I just subscribe to GoSurf99 - 100 MB valid for 30 days for only P99. For others without these internet communication apps, I have 250 free text to all to use.

|

| With internet communication apps, my P1000 lasts for 3-4 months making my budget to around P300/month with internet access |

Vouchers:

There are a lot of companies now offering deals and with the very nice photos and big "savings" advertised, very tempting indeed. But be sure to call the company/store and ask them for the usual price.

A product is currently being advertised with 30% off from an "original price" of P395. Checking the website, it's only P295. The picture I have is a few months old but I don't think the store would have increased their price by more than 25%.

Coffee / Tea / Milk Tea:

I love coffee and tea but I limit my purchase. I always try to look at my budget on a monthly basis.

Ex. a Starbucks coffee on an average would be around P120 plus an ordinary pastry worth P60 can easily add P180 to my daily expenses. Having this 2x a week or 8x a month will add a total of P1440 to my monthly expenses. I try to save by either substituting to a better deal or lesser visit to my fave coffee shop.

Insurance:

Review your insurance policies. Maybe you are paying for something you don't need. If you don't have dependents (or people around you can work and survive when you're not around anymore), you may not need a Life insurance. A Health, accident or pension plan may be a better option. Remember, if you're paying 35K a year for a 1M policy, in 15 years, that is P525,000.

Credit Card:

Make sure to pay your credit card bills on time and in full. Normally the listed interest would be around 3.5% per month. However, it is computed on a daily basis, so if you don't pay by the due date stated, the 3.5% interest doubles. A P10,000 credit card bill will have an estimated charge of 700 (10,000 * 7%) + P500 late charge = P1,200 which represents a hard earned money you will never get to enjoy, amount you may have used for Mobile load, 1month coffee, or a new shirt.

Instalment Plans:

Think 100x before buying anything on instalment.

Example: The monthly amortisation for a new car worth P800,000 will be around P26,300.

P26,300 X 36 months = P946,800

That means paying P146,800 in interest alone for a car that has already depreciated by P150,000 (est.) in 3 years.

Vanity:

I don't find anything wrong with taking care of oneself. But be sure you can actually afford it. Most of my girlfriends go for Manicure (P300) , Pedicure (P400), Hot Oil Treatment (P1200), Facial Treatment (P2000) and Massage (P600) every month. If having all these once a month, that would be P4,500 added to the monthly budget or a whooping P54,000 a year. Doing this every other month would save P27,000/year. Or making a few more adjustments would give more savings. mmm.. I love savings.. :)

|

| Save on salon Hair Treatment by getting really good hair treatment products. Kerastase hair masks costs P1600 but you may use this for 6 months to 1 year. |

I can go on and on but the reality is we should just always be mindful of our finances so that we can save for our future. We can enjoy now but still making sure we can still enjoy life in the years to come. How many people do we know are dependent to their sons or daughters now that they are old and can't work anymore? Or people who need to sell their properties at half the price of the market value because they need money urgently for school or medication? Or a 30-something professional still dependent to his/her parents for life's necessities?

Let us all me be a smart shopper and a dilligent saver.

Comments

Post a Comment